RezySave for Insurers

Transforming Property Insurance Profiles With Preventative Measures

More Attractive to Insurers: Enhancing Property Desirability

Implementing robust risk prevention and management strategies makes properties more desirable to insurers. RezySave’s solutions enable properties to achieve higher safety standards and operational efficiency, leading to more competitive insurance rates and terms.

Robust Risk Prevention

Properties using RezySave’s advanced monitoring and early detection systems have reduced incidents by 30%, making them safer and more attractive to insurers.

Operational Efficiency

Efficient property operations driven by RezySave’s solutions lead to a 20% decrease in claim frequency.

Property Analytics

Detailed property analytics enable more accurate risk assessments, leading to lower premiums for well-managed properties.

Lower Premiums: Reducing Insurance Costs

Enhanced risk prevention measures and property analytics provided by RezySave can lead to lower insurance premiums by significantly reducing the likelihood of claims.

Risk Prevention Measures

Implementing advanced sensors and AI-driven monitoring to detect and prevent incidents has reduced potential claim costs by up to 50%, directly impacting insurance premiums.

Property Analytics

Detailed property analytics enable more accurate risk assessments, leading to lower premiums for well-managed properties.

Improved Coverage: Enhancing Insurance Terms

RezySave’s solutions improve coverage by providing detailed, real-time data that enhances underwriting accuracy and risk assessment, leading to better insurance terms.

Detailed Data Insights

Real-time data on property conditions helps insurers tailor coverage more precisely, ensuring better protection for properties.

Enhanced Underwriting

Provide insurers with accurate and up-to-date information, facilitating more informed underwriting decisions to get favorable coverage terms.

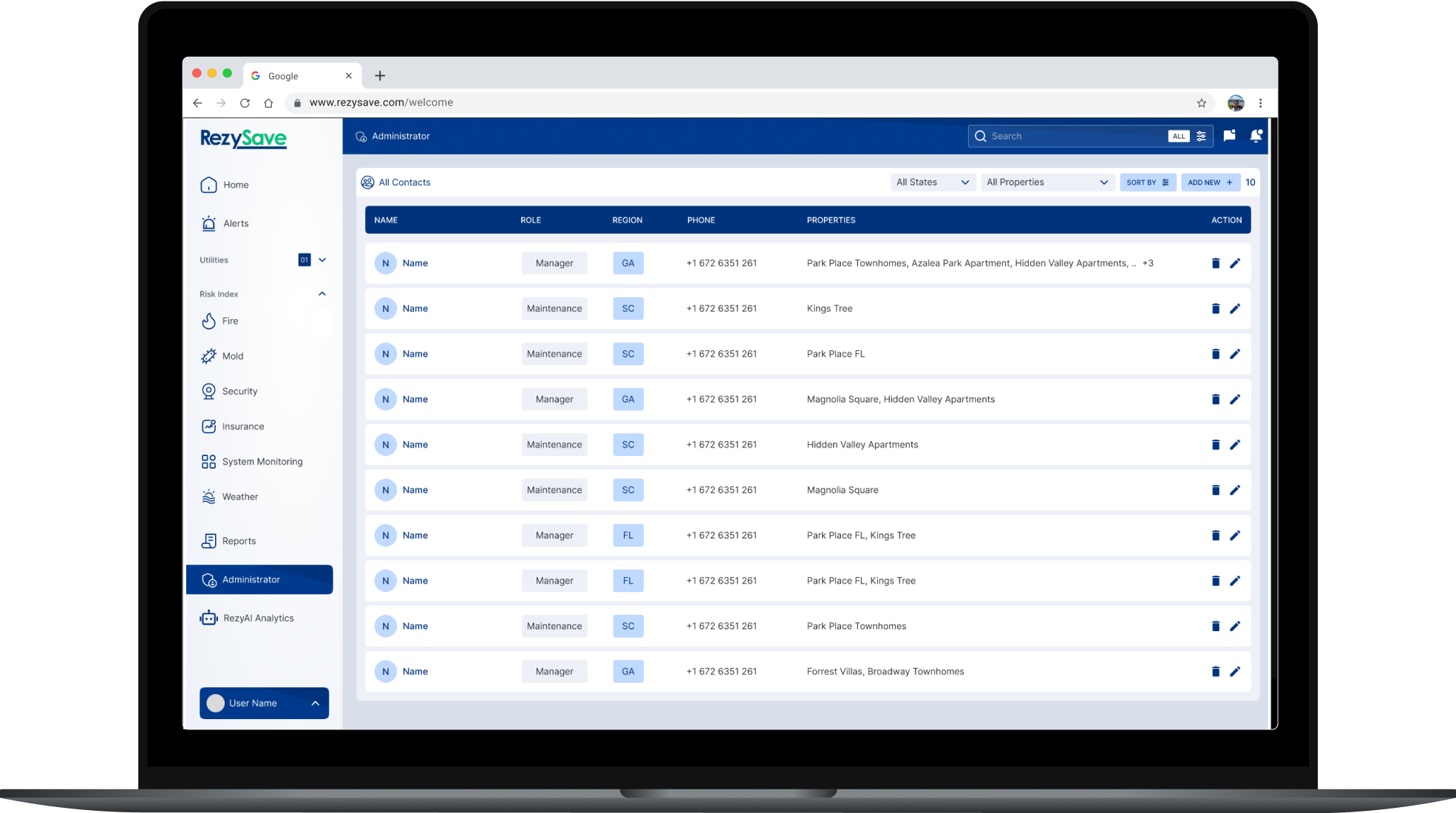

Compliance and Claims Management: Streamlining Processes

Improved compliance with insurance requirements and more efficient claims management are achieved through accurate and real-time data provided by RezySave’s solutions.

Compliance Monitoring

Properties using RezySave’s continuous monitoring and compliance tools maintain a 95% compliance rate, reducing the risk of policy violations.

Efficient Claims Management

Accurate data collection and reporting have reduced claims processing times by 40%, improving insurer and policyholder satisfaction.

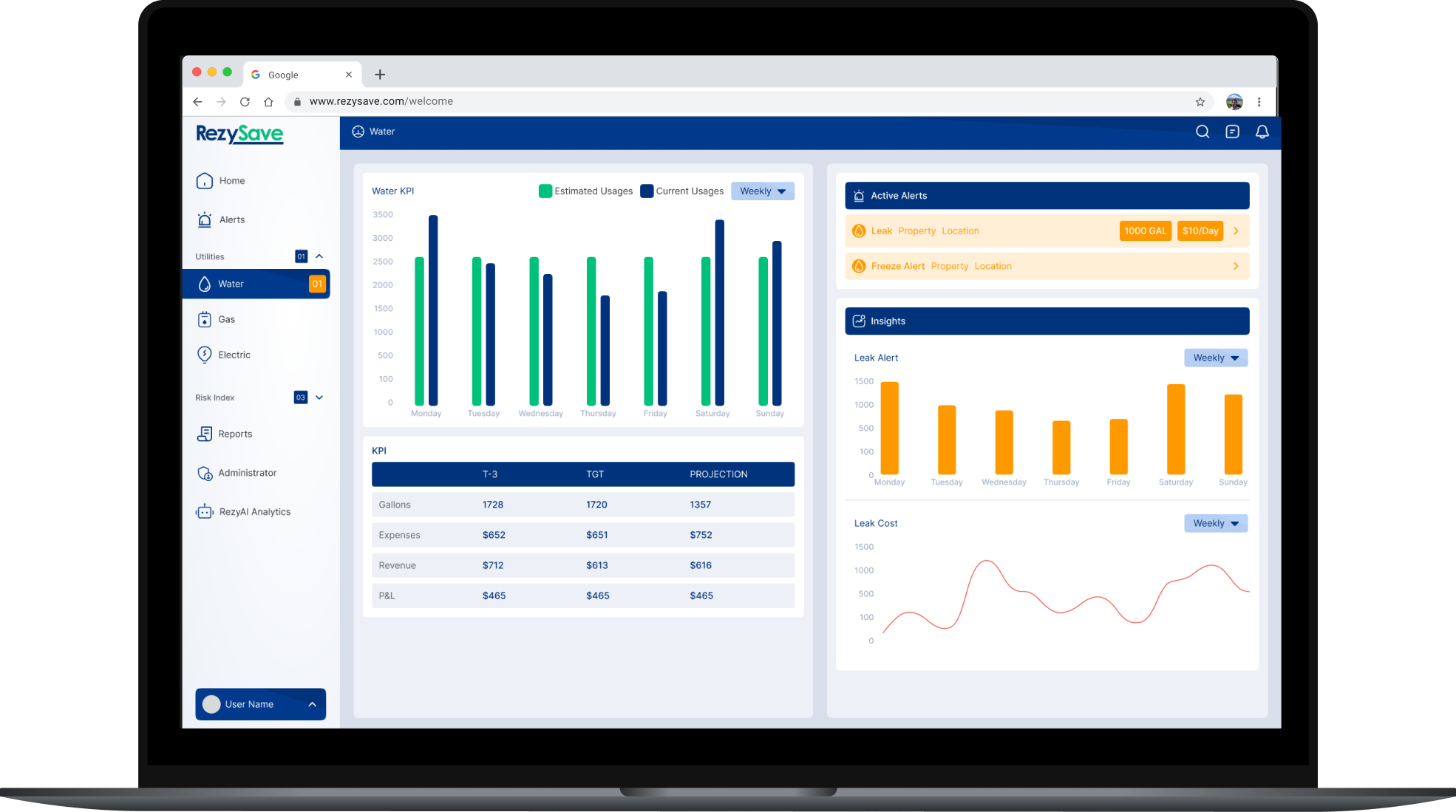

Data for Underwriting: Providing Comprehensive Risk Profiles

RezySave’s comprehensive data collection and analysis capabilities support better underwriting decisions by providing detailed risk profiles and real-time insights.

Comprehensive Data Collection

Data from our proprietary IoT sensors on fire detection systems, water sensors, and security cameras provides insurers with a complete view of property risks.

Real-Time Insights

Insurers using RezySave’s data have improved their underwriting accuracy by 30%, leading to better risk management and pricing.

.png?width=357&height=500&name=insurance%20(1).png)